Indexed Universal Life (IUL) insurance policies have gained popularity in recent years as a way to provide both life insurance coverage and potential cash value growth. However, it is important for consumers to be cautious when considering an IUL policy, as there are potential risks and drawbacks associated with this type of insurance.

One major concern with IUL policies is the complexity of the product. Unlike traditional whole life or term life insurance policies, IUL policies involve a cash value component that is tied to the performance of a stock market index, such as the S&P 500. This means that the policyholder’s cash value can fluctuate based on market conditions, which can be difficult for some individuals to understand and keep track of.

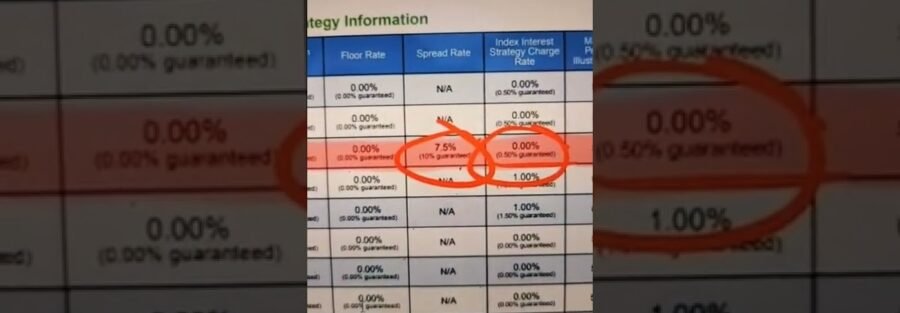

Additionally, IUL policies often come with high fees and expenses, which can eat into the policyholder’s cash value and potentially reduce the overall returns on the policy. These fees can include cost of insurance charges, policy administration fees, and charges for the indexing feature of the policy. It is important for consumers to carefully review and understand all fees associated with an IUL policy before purchasing.

Another potential risk with IUL policies is the cap on potential returns. Many IUL policies have a cap on the amount of growth that the cash value can experience in a given year. This cap can limit the policyholder’s ability to benefit from strong market performance, and may prevent the policy from keeping pace with inflation over time. It is important for consumers to consider whether the potential returns of an IUL policy are sufficient to meet their financial goals.

In addition to these risks, there are also concerns about the sales practices of some insurance agents who sell IUL policies. Some agents may downplay the risks and complexities of IUL policies in order to make a sale, without fully disclosing all relevant information to the consumer. This can lead to buyers purchasing a policy that is not suitable for their needs or financial situation.

World Financial Group (WFG) is a company that offers IUL policies among its wide range of financial products and services. While WFG is a reputable company with a strong track record of providing financial education and guidance to consumers, it is important for individuals to carefully consider whether an IUL policy is the right choice for them before purchasing through WFG or any other insurance provider.

In conclusion, while Indexed Universal Life insurance policies offer the potential for cash value growth and life insurance coverage, there are significant risks and drawbacks associated with these policies. Consumers should carefully review and understand all aspects of an IUL policy, including fees, caps on potential returns, and sales practices, before making a decision to purchase. Working with a reputable financial services provider like World Financial Group can help ensure that consumers make informed choices about their insurance needs.