Finding the best term life insurance rates for seniors can be a challenge. But it’s important to secure coverage to protect your loved ones. This guide will help you understand what to look for. We will also share some tips to get the best rates.

Credit: www.policygenius.com

What is Term Life Insurance?

Term life insurance provides coverage for a set period, or “term”. If the insured person passes away during the term, the beneficiaries get a death benefit. This type of insurance is usually cheaper than whole life insurance. It is ideal for seniors who want coverage without high premiums.

Why Should Seniors Consider Term Life Insurance?

As people age, their financial responsibilities change. Seniors might want to leave money for their loved ones. They might also want to cover funeral expenses. Term life insurance can provide peace of mind. It ensures that family members are protected from financial burdens.

Factors That Affect Term Life Insurance Rates

Several factors influence the cost of term life insurance for seniors. Understanding these can help you get the best rates.

- Age: Older seniors usually pay higher premiums.

- Health: Better health often means lower rates.

- Term Length: Longer terms cost more.

- Coverage Amount: Higher coverage means higher premiums.

- Smoking Status: Smokers pay more for insurance.

How to Get the Best Term Life Insurance Rates for Seniors

There are several strategies seniors can use to get the best rates. Here are some tips to help you save money.

Compare Multiple Quotes

It’s important to shop around. Get quotes from different insurance companies. This will help you find the best rates. Use online comparison tools to make this process easier.

Choose The Right Term Length

Think about how long you need coverage. If you only need insurance for a few years, choose a shorter term. This can save you money on premiums.

Improve Your Health

Maintaining good health can lower your insurance rates. Regular check-ups, a healthy diet, and exercise can help. If you have health issues, manage them well.

Consider A Medical Exam

Some policies don’t require a medical exam, but these can be more expensive. If you’re in good health, consider taking a medical exam. This could result in lower premiums.

Work With An Independent Agent

Independent agents work with many insurance companies. They can help you find the best rates. They can also provide personalized advice based on your needs.

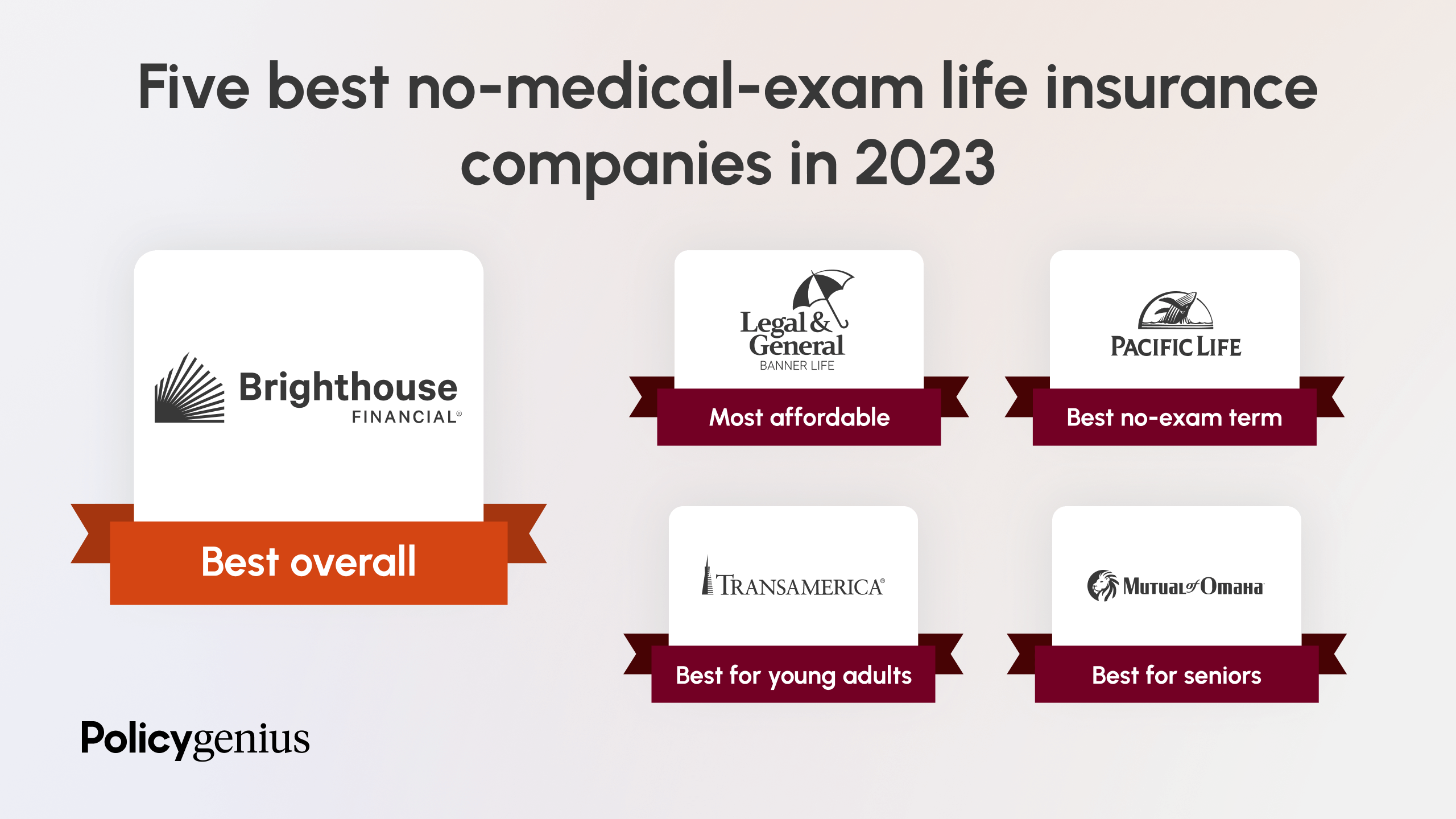

Top Insurance Companies for Seniors

Here are some insurance companies known for offering good rates to seniors. These companies have strong reputations and good customer service.

| Company | Strengths |

|---|---|

| Mutual of Omaha | Competitive rates and no medical exam policies. |

| AIG | Flexible term lengths and high coverage amounts. |

| Transamerica | Affordable premiums and good customer service. |

| Prudential | Strong financial stability and customizable policies. |

Credit: seniorsmutual.com

Frequently Asked Questions

What Is Term Life Insurance For Seniors?

Term life insurance provides coverage for a specified period, offering financial security to seniors’ beneficiaries.

How To Get The Best Rates?

Shop around and compare quotes from multiple insurers to find the most competitive rates.

Are Medical Exams Required?

Some insurers offer no-exam policies, but these may come with higher premiums.

Can Seniors Over 70 Get Term Life Insurance?

Yes, many insurers offer term life policies for seniors over 70, though rates may be higher.

Conclusion

Securing the best term life insurance rates for seniors is possible. By understanding your needs and shopping around, you can find affordable coverage. Remember to compare quotes and consider working with an independent agent. This can help you save money and protect your loved ones.

FAQs

Is Term Life Insurance A Good Option For Seniors?

Yes, term life insurance can be a cost-effective way for seniors to get coverage.

Can Seniors Get Term Life Insurance Without A Medical Exam?

Yes, some companies offer no medical exam policies, but they can be more expensive.

How Long Should The Term Be For Senior Life Insurance?

The term length depends on your needs. Shorter terms are cheaper, but longer terms provide extended coverage.

What Is The Best Way To Find Affordable Term Life Insurance For Seniors?

Shop around, compare quotes, and consider working with an independent agent to find the best rates.

What Happens If The Term Ends And The Insured Is Still Alive?

If the term ends and the insured is still alive, the coverage ends, and no benefits are paid out.