Life insurance is important for many families. It helps protect your loved ones. But do life insurance rates increase with age? Let’s find out.

Understanding Life Insurance

Life insurance is a contract. You pay premiums to an insurance company. In return, the company pays a sum of money to your beneficiaries when you pass away.

Types of Life Insurance

There are different types of life insurance. The two most common types are term life insurance and whole life insurance.

Term Life Insurance

Term life insurance covers you for a specific period. This could be 10, 20, or 30 years. If you die within this term, the insurance company pays your beneficiaries.

Whole Life Insurance

Whole life insurance covers you for your entire life. It also builds cash value over time. This can be used for loans or to pay premiums.

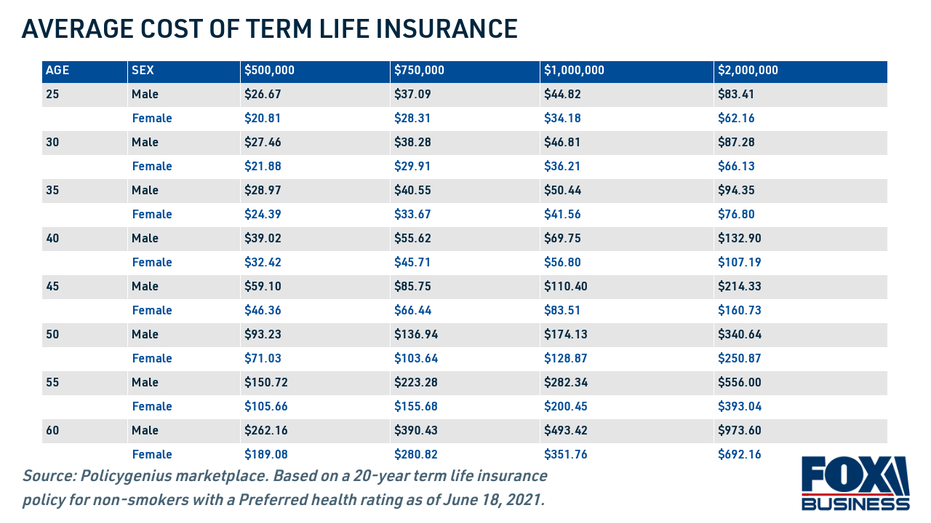

Credit: www.foxbusiness.com

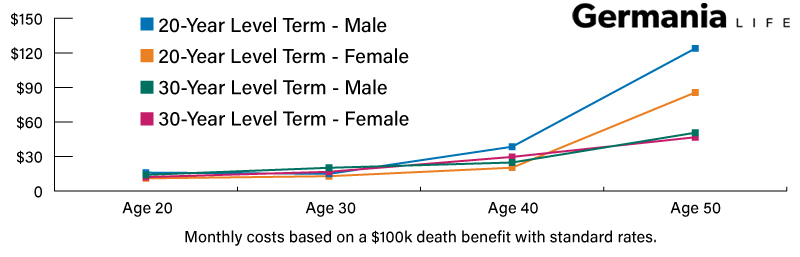

Credit: germaniainsurance.com

How Age Affects Life Insurance Rates

Age plays a big role in determining life insurance rates. Generally, the younger you are, the lower your premiums will be.

Why Do Rates Increase With Age?

As you get older, the risk of health problems increases. Insurance companies see older individuals as higher risk. This leads to higher premiums.

| Age | Monthly Premium (Term Life) | Monthly Premium (Whole Life) |

|---|---|---|

| 25 | $20 | $100 |

| 35 | $30 | $150 |

| 45 | $50 | $200 |

| 55 | $80 | $300 |

When to Buy Life Insurance

The best time to buy life insurance is when you are young and healthy. This will help you secure lower premiums.

Buying At A Young Age

Buying life insurance in your 20s or 30s can save you money. You can lock in lower rates for the duration of your policy.

Buying Later In Life

If you wait until your 40s or 50s, you will pay higher premiums. However, it is still important to have coverage. The peace of mind it provides is priceless.

Tips to Save on Life Insurance

There are ways to save on life insurance, even if you are older. Here are some tips to help you.

- Compare quotes from different insurance companies.

- Consider term life insurance for lower premiums.

- Maintain a healthy lifestyle to lower your risk.

- Choose the right coverage amount for your needs.

- Pay premiums annually to save on fees.

Frequently Asked Questions

Do Life Insurance Rates Increase With Age?

Yes, life insurance rates generally increase as you age due to higher health risks.

Why Does Age Affect Life Insurance Rates?

Older individuals pose higher health risks, leading to increased premiums for life insurance policies.

At What Age Are Life Insurance Rates Highest?

Life insurance rates are usually highest for individuals above 50 years old.

Is It Cheaper To Buy Life Insurance Young?

Yes, purchasing life insurance at a younger age typically results in lower premiums.

Conclusion

Life insurance rates do increase with age. The younger you are, the lower your premiums will be. However, it is never too late to get coverage. Protecting your loved ones is always a wise decision.

Remember to compare quotes and choose the right policy for your needs. Stay healthy and plan ahead. Your future self and your family will thank you.