Life insurance is very important. It protects your loved ones. But, how much should you pay for life insurance? Let’s find out together.

Factors That Affect Life Insurance Costs

The cost of life insurance varies. Many factors affect the price. Here are some key factors:

- Age: Younger people pay less.

- Health: Healthier people pay less.

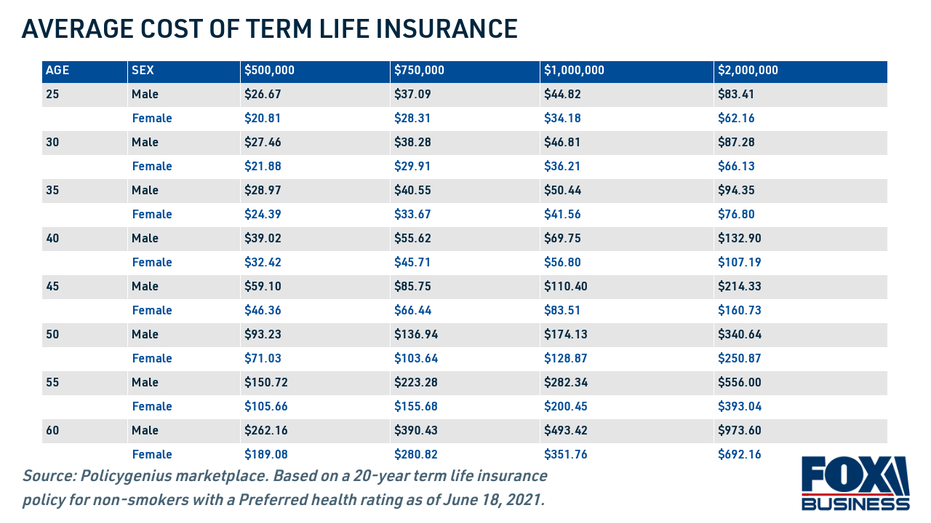

- Gender: Women usually pay less than men.

- Lifestyle: Smokers pay more than non-smokers.

- Occupation: Risky jobs cost more.

- Policy Type: Term life is cheaper than whole life.

:max_bytes(150000):strip_icc()/life-insurance-policies-how-payouts-work.asp-final-8b7370a242df451d9caea293bc6eb300.png)

Credit: www.investopedia.com

Types of Life Insurance

There are different types of life insurance. Each type has different costs. Let’s look at the main types:

Term Life Insurance

Term life insurance is simple. It covers you for a set time. It can be 10, 20, or 30 years. If you die during this time, your family gets money. Term life insurance is cheaper. But, it only lasts for a set time.

Whole Life Insurance

Whole life insurance lasts your whole life. It costs more than term life. But, it builds cash value. This means you can borrow money from it. Whole life insurance is good if you want lifelong coverage.

Universal Life Insurance

Universal life insurance is flexible. You can change your payments. You can also change your coverage amount. It also builds cash value. But, it can be complex and expensive.

How Much Should You Pay?

The amount you pay depends on many factors. But, there are some general guidelines. Let’s look at some examples:

| Age | Policy Type | Coverage Amount | Monthly Cost |

|---|---|---|---|

| 30 | Term (20 years) | $500,000 | $20-$30 |

| 40 | Term (20 years) | $500,000 | $30-$40 |

| 30 | Whole Life | $500,000 | $200-$300 |

| 40 | Whole Life | $500,000 | $300-$400 |

These are just examples. Your cost might be different. But, this table gives you an idea of what to expect.

Tips to Save Money on Life Insurance

You can save money on life insurance. Here are some tips:

- Buy When You’re Young: Younger people get lower rates.

- Stay Healthy: Eat well and exercise. Avoid smoking.

- Compare Quotes: Get quotes from many companies. Compare them to find the best deal.

- Choose Term Life: Term life is cheaper. It’s a good option if you need coverage for a set time.

- Review Your Policy: Review your policy every few years. Make sure it still meets your needs.

Credit: www.foxbusiness.com

Frequently Asked Questions

What Factors Influence Life Insurance Costs?

Age, health, lifestyle, and coverage amount are key factors.

How Can I Save Money On Premiums?

Opt for term life insurance and maintain a healthy lifestyle.

Is Term Life Insurance Cheaper?

Yes, term life insurance is generally cheaper than whole life insurance.

Does Smoking Affect Life Insurance Rates?

Yes, smoking significantly increases life insurance premiums.

Conclusion

Life insurance is important for your family’s future. The cost depends on many factors. Age, health, and type of policy all affect the price. Use our tips to save money. Compare quotes and choose the best policy for you. Protect your loved ones with the right life insurance.