In this video I’m going to be talking about how to read a life insurance quote or illustration and things to look out for that you might …

Life insurance is a crucial financial tool that can provide financial protection to your loved ones in the event of your passing. However, understanding life insurance quotes and illustrations can be quite complex for the average person. It is essential to educate yourself on how to read and understand life insurance quotes to ensure you are getting the right coverage for your needs.

When you request a life insurance quote, insurance companies will provide you with details about the policy, coverage amount, premiums, and benefits. It is essential to carefully review these details and understand what they mean before making a decision. Here are some important tips on how to read a life insurance quote and what you must know about life insurance illustrations.

1. Understand the type of coverage: Life insurance quotes usually come in two types: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage. Make sure you understand the difference between the two types of coverage and choose the one that best fits your needs.

2. Determine the coverage amount: The coverage amount on a life insurance quote refers to the amount of money your beneficiaries will receive upon your passing. It is crucial to calculate the right coverage amount based on your financial needs, such as outstanding debts, mortgage payments, childcare expenses, and funeral costs. Make sure the coverage amount on the quote is sufficient to provide for your loved ones.

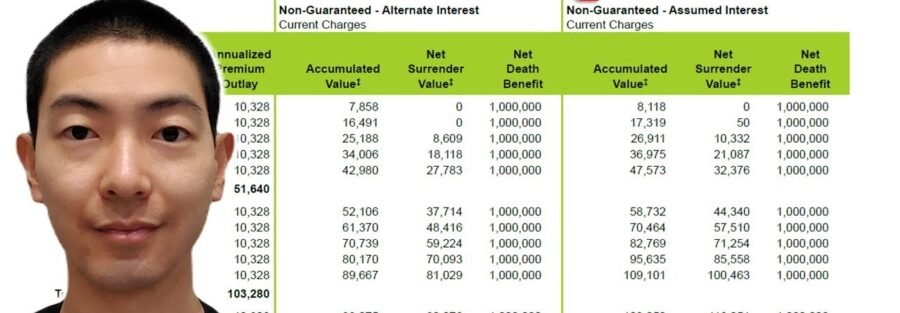

3. Examine the premiums: The premiums on a life insurance quote are the payments you will make to the insurance company to maintain coverage. It is essential to understand how premiums are calculated and how they may change over time. Make sure the premiums are affordable and fit within your budget.

4. Review the benefits: Life insurance quotes will outline the benefits that come with the policy, such as death benefits, cash value accumulation, and riders. It is crucial to understand these benefits and how they can enhance your coverage. Look for additional features, such as accelerated death benefits or waiver of premium riders, that can provide extra protection for you and your loved ones.

5. Consider the illustration: Life insurance illustrations are visual representations of how the policy may perform over time. They show projections of premiums, cash values, and death benefits based on certain assumptions. It is essential to carefully review the illustration and pay attention to the assumptions used, such as interest rates, policy fees, and dividend projections. Make sure the illustration is realistic and aligns with your financial goals.

In conclusion, reading a life insurance quote can be overwhelming, but understanding the key components is crucial to making an informed decision. By following these tips and asking questions, you can ensure you are getting the right coverage for your needs. Remember to compare quotes from different insurance companies to find the best policy that fits your budget and provides the protection your loved ones deserve. Life insurance is a valuable asset that can provide peace of mind and financial security for you and your family, so take the time to educate yourself and make the right choice.