Indexed Universal Life insurance can be a great addition to your portfolio for tax efficient cash growth that is not correlated to …

Indexed Universal Life (IUL) insurance policies have become increasingly popular in recent years due to their potential for cash value growth tied to a stock market index. However, many policyholders have been left disappointed when their IUL policies fail to perform as expected. One of the most common reasons for this poor performance is a design flaw in the policy itself.

Indexed Universal Life policies are complex financial instruments that are meant to provide both insurance coverage and a way to build cash value over time. The cash value in an IUL policy is supposed to grow based on the performance of a stock market index, such as the S&P 500. However, many policyholders have found that their cash value growth is much lower than they were led to believe when they first purchased the policy.

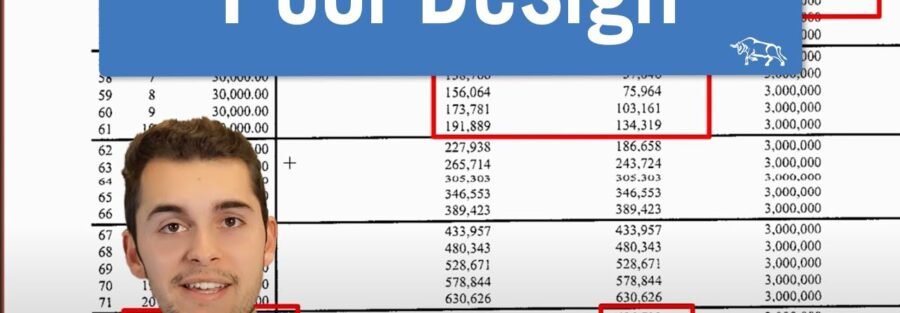

One major reason for this discrepancy in cash value growth is the design of the IUL policy itself. In many cases, policyholders are not made aware of the high fees and costs associated with these policies. These fees can eat away at the cash value growth, leaving policyholders with much less money than they expected.

Another design flaw in many IUL policies is the cap on the potential growth of the cash value. Insurance companies often impose a cap on the amount of cash value that can be earned in a given year, leading to lower returns for policyholders. Additionally, some policies have a participation rate that limits the amount of the index’s performance that is credited to the cash value.

Furthermore, many policyholders have complained about the lack of transparency in the way their IUL policies are managed. Insurance companies have been known to change the terms of the policy without notifying the policyholder, leading to confusion and frustration.

In order to avoid falling victim to a poorly designed Indexed Universal Life policy, it is important for potential policyholders to do their due diligence before purchasing. This includes carefully reading all of the fine print in the policy, understanding the fees and costs associated with the policy, and asking questions about how the policy is managed.

Additionally, it is important to work with a reputable insurance agent who can help navigate the complexities of Indexed Universal Life policies. An experienced agent can help ensure that the policy is structured in a way that will maximize cash value growth and provide the coverage needed.

It is also important for policyholders to regularly review their IUL policy to ensure that it is still meeting their financial goals. If the policy is not performing as expected, it may be time to consider alternatives, such as surrendering the policy and investing in a different financial instrument.

In conclusion, Indexed Universal Life policies can be a valuable tool for building cash value over time, but many policyholders have been left disappointed when their policies fail to perform as expected. By understanding the design flaws in many IUL policies and working with a knowledgeable insurance agent, policyholders can avoid the pitfalls of a poorly designed policy and make the most of their investment.